Why Spot +4C Niran represents a paradigm shift in trading automation

Enrollment in Spot +4C Niran

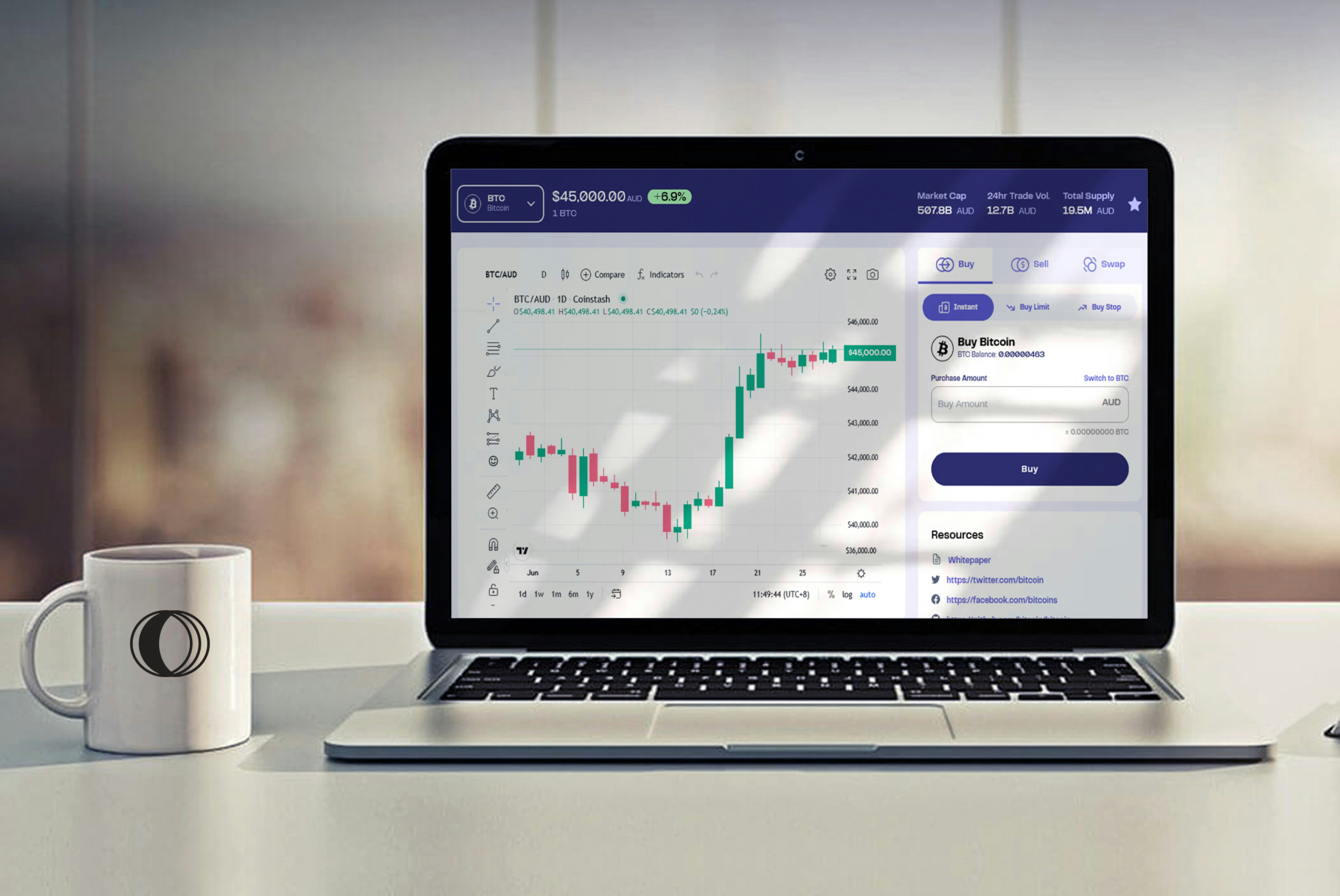

Spot +4C Niran emerges as a landmark innovation in automated financial technology, engineered by Spot Niran to equip traders with high-velocity, algorithmically-generated market intelligence. By prioritizing intuitive design and operational supremacy, Spot +4C Niran gives users the power to deploy automated investment frameworks, minimize operational drag, and strategically leverage real-time market phenomena.

Core competencies and functionalities

Algorithmic precision

Leverages a sophisticated computational framework for high-fidelity trade execution.

Multi-market framework

Provides access to a diverse ecosystem of asset classes, including digital currencies, equities, and commodities.

Ergonomic design

Features a minimalist interface crafted for seamless interaction by traders of all experience levels.

By the synergy of a frictionless user interface and formidable processing power, Spot +4C Niran offers a holistic suite of trading solutions. This positions it as an indispensable asset in markets where efficiency and unwavering reliability are paramount.

The architectural evolution of Spot +4C Niran

Spot +4C Niran, the advanced successor to Spot Niran, introduces a portfolio of transformative features engineered to redefine industry benchmarks in trading automation. Built upon the robust chassis of Spot Niran, this new iteration delivers a profoundly more versatile and potent system.

Upgraded algorithmic engine

Spot +4C Niran is powered by a next-generation algorithmic core that deciphers live market data streams, affording users the ability to execute transactions at a velocity previously unachievable with the legacy Spot Niran system. This fundamental enhancement mitigates slippage and fortifies execution accuracy in volatile conditions.

Expanded asset universe

The platform’s infrastructure supports a vast spectrum of tradable instruments, from digital assets to traditional stocks and commodities. Moving beyond the narrower scope of its predecessor, Spot +4C Niran enables users to construct sophisticated, cross-asset portfolios, thereby optimizing risk dispersion and unlocking greater alpha potential.

Bespoke operational environment

Spot +4C Niran boasts a visually refined and logically structured user interface, complete with deeply configurable dashboards. Traders can modulate strategic parameters and establish custom alert systems, fostering a trading environment that is perfectly harmonized with their individual methodology.

| Metric | Spot +4C Niran | Spot Niran |

|---|---|---|

| Execution velocity | Engineered for near-instantaneous response | Standard latency |

| Asset spectrum | Comprehensive access (digital, stocks, commodities) | Confined to a limited set of instruments |

| Interface modularity | Full granular control over display and alerts | Rudimentary customization |

| Risk mitigation tools | Inbuilt, adjustable risk-control mechanisms | Previously not integrated |

Spot +4C Niran comes equipped with embedded risk management systems, such as dynamic stop-loss and limit orders. These critical additions provide traders with superior command over risk exposure in turbulent markets—a capability absent in the original Spot Niran.

In essence, Spot +4C Niran integrates these pioneering components to forge a more resilient, adaptable, and secure trading journey, establishing itself as an excellent choice among automated trading platforms.

Strategic advantages for traders in the Netherlands

Spot +4C Niran delivers a suite of compelling advantages meticulously calibrated for the sophisticated financial ecosystem of the Netherlands, blending high performance with robust security and adaptability for all traders.

Decisive benefits for Netherlands-based traders

1. Real-time execution efficiency

Spot +4C Niran leverages state-of-the-art algorithms that react to market stimuli in microseconds, empowering users in the Netherlands to execute trades with unparalleled temporal accuracy. This agility is non-negotiable in today’s high-frequency trading environments.

2. Unrestricted asset diversification

The platform facilitates engagement with a broad array of assets, including digital currencies, equities, and commodities. This allows traders in the Netherlands to implement comprehensive diversification strategies, consolidated within a single, unified interface, negating the need for multiple platforms.

3. Localized support infrastructure

Spot +4C Niran provides a comprehensive support network specifically configured for its user base in the Netherlands. This includes 24/7 access to a specialized team with in-depth knowledge of the local regulatory landscape and market dynamics, ensuring operational continuity.

4. Fortified security architecture

Recognizing the stringent security expectations in the Netherlands, Spot +4C Niran integrates military-grade data encryption and multi-layered account protection protocols, providing users with absolute confidence in the security of their capital.

| Component | Spot +4C Niran for the Netherlands | Advantage for traders |

|---|---|---|

| Latency optimization | Real-time execution | Maximized timing for entry/exit points |

| Portfolio breadth | Multi-asset accessibility | Holistic portfolio diversification and risk management |

| Localized expertise | 24/7 specialized support | Seamless navigation of local market intricacies |

| Fortified security | Advanced cryptographic safeguards | Uncompromising protection of capital and data |

With these attributes, Spot +4C Niran directly addresses the nuanced requirements of the trading community in the Netherlands, solidifying its position as a premier tool for those demanding a sophisticated and secure automated trading solution.

Step-by-step guide

1. Account provisioning

Navigate to the official Spot Niran web portal and select the “Register” command.

Submit the required personal data for identity verification, including your full name, email address, and contact number.

2. Initial capitalization

A minimum initial funding amount is required by Spot Niran to activate your account’s full capabilities. Comply with the instructions for the transfer.

3. Simulated environment training

Utilize the Spot +4C Niran demo account to develop a thorough understanding of the platform’s extensive feature set in a risk-free setting.

4. Strategy parameterization

Configure your operational directives, including asset class selection, risk tolerance thresholds, and preferred trade execution frequency.

5. Live deployment

Once you have attained proficiency and confidence, transition to live trading mode to deploy your automated strategies as per your configurations.

| Phase | Description |

|---|---|

| Registration | Complete the digital sign-up form on the Spot Niran portal |

| Capital funding | Deposit funds to support operational costs and trading capital |

| Simulation | Engage in practice trading within a zero-risk simulated environment |

| Parameter configuration | Define the operational rules for the automated trading system |

| Commence trading | Activate your predefined strategies for live market engagement |

Thanks to the user-centric design of Spot +4C Niran, operators can rapidly establish their trading parameters and execute complex tactics with ease.

Diverse operational scenarios for Spot +4C Niran

Spot +4C Niran is engineered with the flexibility to serve a multitude of user profiles, strategic objectives, and market conditions. Consider the following use-cases to appreciate its adaptability:

1. High-frequency intraday operations

The exceptional speed and reactivity of Spot +4C Niran make it an ideal tool for intraday trading, where capturing fleeting market movements is key. Its automated algorithms enable users to capitalize on micro-trends within moments. Intraday operators can fine-tune parameters to pursue specific profit targets while methodically managing risk.

| Capability | Benefit for traders |

|---|---|

| Real-time data analysis | Continuously scans for and identifies market micro-movements |

| Expedited execution | Enables the rapid placement and cancellation of orders |

| Adjustable risk thresholds | Provides precise control over capital exposure and volatility |

2. Long-horizon asset accumulation

For investors focused on long-term wealth creation, Spot +4C Niran provides the analytical tools to support sustainable growth strategies. Surpassing the limitations of the previous Spot Niran version, it allows investors to oversee a wider asset universe and strategically allocate capital to more stable instruments, charting a more secure investment course.

3. Systemized portfolio diversification

Spot +4C Niran empowers traders to systematically invest across a curated mix of digital assets, stocks, and commodities to achieve a robustly diversified portfolio. This strategy is particularly valuable for investors aiming to mitigate idiosyncratic risk by distributing their capital across non-correlated asset classes.

| Strategy | Application within Spot +4C Niran |

|---|---|

| Systematic diversification | Reduces portfolio vulnerability to asset-specific downturns |

| Dynamic rebalancing | Maintains strategic asset allocation through automated adjustments |

With its multifaceted feature set, Spot +4C Niran seamlessly adapts to diverse investment philosophies, offering impeccable automated trading execution.

Assessing your compatibility with the Spot +4C Niran platform

For investors who demand cutting-edge automation, versatile application, and high-velocity analytics, Spot +4C Niran offers a direct conduit to streamlined trading. Its combination of intuitive design, peak performance, and comprehensive risk controls makes it a potentially ideal solution.

| User profile | Why Spot +4C Niran is appropriate |

|---|---|

| Novice traders | Offers a simplified setup and a risk-free simulation account for practical training. |

| Veteran traders | Provides advanced parameterization and supports complex, multi-asset trading strategies. |

| Traders in the Netherlands | Features dedicated, 24/7 customer support from representatives with local market knowledge. |

How it compares to Spot Niran

While Spot Niran laid the groundwork, Spot +4C Niran represents a quantum leap in automated response capabilities. By providing superior asset optionality and deeper customization, it stands as the definitive choice for users who require advanced functionality and strategic flexibility.

JOIN US TODAYFrequently asked questions

Spot +4C Niran is a sophisticated automated trading system designed to enhance trading outcomes with high-speed, configurable settings across a wide range of digital and traditional assets.

The primary differentiators are the advanced customizable parameters, superior automation logic, and integrated risk management tools exclusive to Spot +4C Niran.

The platform caters to a wide spectrum of users, from those new to trading to seasoned professionals, all of whom can leverage its demo accounts and optimized methodologies.

Indeed, a version tailored for the Netherlands is fully operational, providing users with access to the platform's complete suite of services and specialized local support.

The platform provides extensive options, facilitating diversification across stocks, commodities, and digital assets, thereby offering investors broad selection and strategic confidence.

By registering and funding an account through the official portal, users gain comprehensive access to all platform functions. The demo mode is strongly recommended for preliminary practice.

Unquestionably. All transactions and financial data are secured with robust cryptographic encryption, guaranteeing the financial privacy and contractual security of all users, including traders in the Netherlands.